Apple becomes first public company to reach a $2 trillion market cap

- The Tech Platform

- Aug 22, 2020

- 2 min read

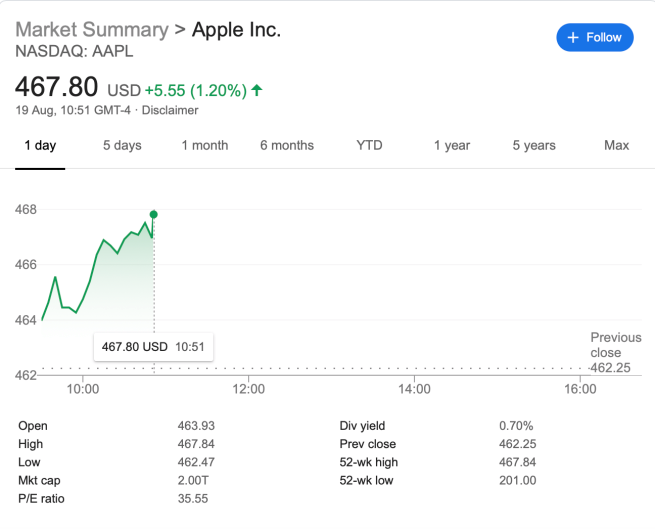

Apple has become the first public company to hit the magic milestone of having a $2 trillion market capitalization, just two years after it crossed the $1 trillion mark.

Market cap is the value of a share multiplied by number of shares, thereby seen as the overall value of a publicly traded firm. Apple has seen its stock almost double this year off of COVID pandemic lows in March. Investor confidence rebounded as Apple delivered strong revenue growth in many business divisions last quarter, with its services division offering promising monetization opportunities over the next few years.

Despite wider macroeconomic weakness, big tech companies have seen their stocks surge in the last few months.

AAPL stock fell to lows of $230 in March amongst the height of the coronavirus lockdowns, which saw Apple close all of its retail stores worldwide. However, iPhone sales have been reasonably resilient and Apple’s other business segments — like iPad and Mac — have performed well as more customers transition to working from home.

AAPL stock exceeded $2 trillion market cap today when it crossed the $467.77 level.

Looking forward, investors are excited by the possibilities of Apple’s content subscription services to drive more ongoing revenue. Apple led the subscriptions charge with Apple Music and is looking to repeat its success with other media. Services like Apple TV+, Apple News+, and Apple Arcade have had slow starts out of the gate but many believe they will catch on as Apple invests even more in content production and new features.

Later this year, Apple is expected to bundle all of these services into an Amazon Prime like bundle codenamed Apple One.

The financial community is also hoping for a strong cycle of iPhone sales with the iPhone 12 with support for fast 5G cellular excepted to encourage customers to upgrade. The new iPhone lineup is expected to launch in October.

Of course, stock market value can go down as well as up. For instance, if iPhone 12 sales miss expectations, if Apple cannot entice people onto its forthcoming subscription bundles, if the coronavirus pandemic returns for a damaging ‘second wave’, or if governments crackdown on the App Store monopoly in a way that financially hurts, the stock could fall back down.

Source: Paper.li

Comments